The $5 Billion Creator HoldCo

As Beast Industries seeks a $5 billion valuation, we explain how creator HoldCos emerged, why they appeal to creators & investors, and how we’d evaluate such an investment.

Bloomberg recently reported that MrBeast is looking to raise capital at a $5 billion valuation. At Will Ventures, we had two main takeaways from the news.

Takeaway #1 is what everyone’s been saying: MrBeast is building the ultimate creator flywheel. He drove $500 million in revenue in 2024. Interestingly, his content business lost $80 million, while his chocolate brand Feastables profited $20 million. MrBeast’s strategy is clearly to use his massive content business as a loss-leader and marketing arm for even larger businesses, starting with CPG.

It’s tempting to point to MrBeast’s potential $5 billion valuation and declare, “Creators are the future, and Jimmy Donaldson will be the first of many YouTubers turned business moguls!” But the truth is: MrBeast is a one-of-one. His 377 million YouTube subscribers are almost triple the next non-brand-owned channel. And industry executives broadly agree that MrBeast’s ruthless ambition and obsessive work ethic are unmatched. His leaked manifesto and Diary of a CEO interview show that.

MrBeast is not a fair proxy for the growth of the creator economy. That’s why we believe there’s a more interesting takeaway from the Bloomberg article - which specifically called our attention as investors.

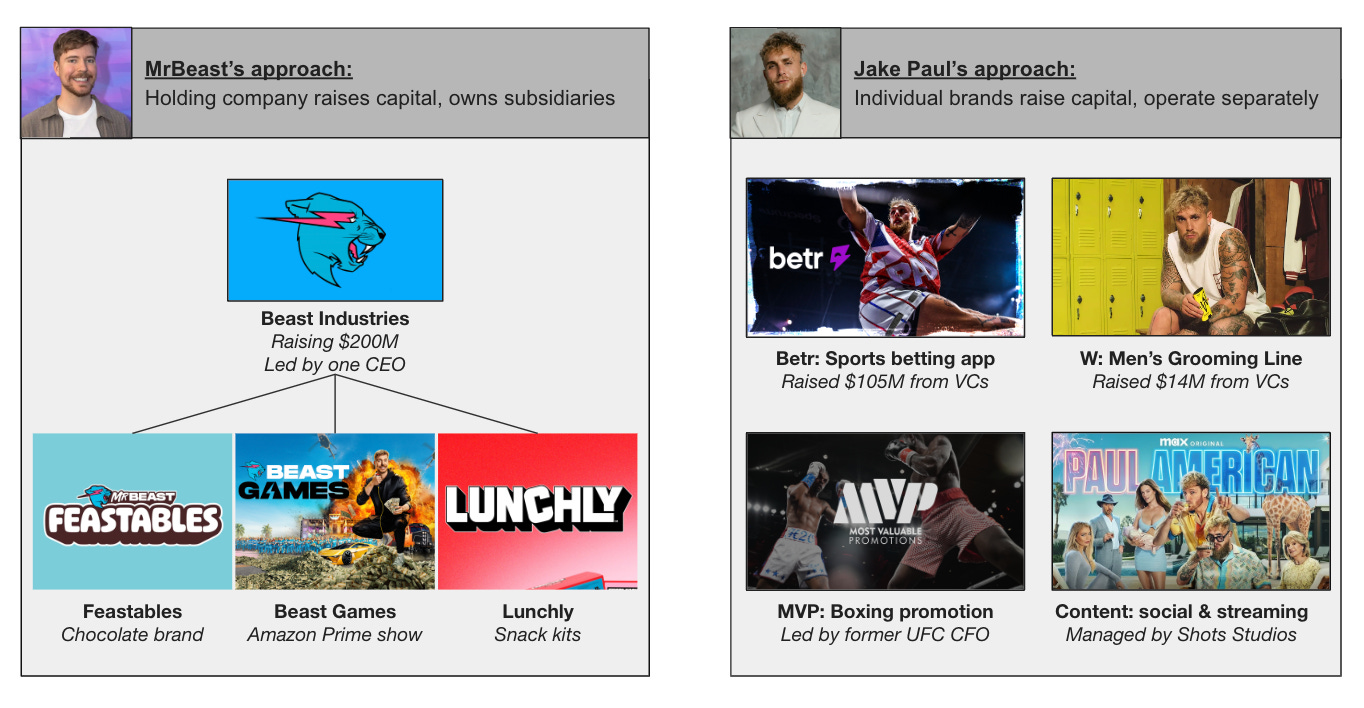

Takeaway #2 is: MrBeast has structured his business in a highly-innovative way. Beast Industries is one central holding company that includes all of his assets – from his YouTube content, to his Amazon Prime series, to Feastables, to Lunchly, to merchandise, to new cereal and snack lines they may launch in the future. Beast Industries has raised $450 million to date, and is looking to raise another $200 million, at the HoldCo level.

Historically, creators have mostly built businesses and raised capital for individual assets. For example, Jake Paul has partnered with different CEOs and/or raised separate funding for his betting platform Betr, his grooming line W, and his boxing promotion company MVP. However, Beast Industries is leveraging one centralized entity, balance sheet, and executive team.

We believe this HoldCo model has been key to MrBeast’s success, and we predict more creators will use this model to raise capital and operate their businesses. We broke down this essay into three parts:

How did the creator HoldCo model emerge?

Why does the model appeal to creators and investors?

How would we evaluate an investment into a creator HoldCo?

Part 1: How did the HoldCo model emerge?

From 2020-2021, VCs rushed to invest in the creator economy. Investors saw huge secular tailwinds: Gen Z spending more time on social media, brands spending more on influencers, etc. And at the start of Covid, when everyone was stuck indoors, all these trends spiked.

During this boom, VCs mostly invested in software for the creator economy. Think monetization platforms like Patreon and Cameo, and tools like Canva and Linktree. But the category saw fewer successes than expected, as most of the value accrued to the dominant platforms like YouTube and Tik Tok. So VC funding dried up. Only in the last year, creator software funding rebounded slightly, thanks to a few successes like ShopMy and Kajabi.

Although most funding went towards software, some investors took a different approach to the creator economy: investing directly in creators themselves.

What does this look like? We’ve mostly seen creators a) finance their content catalogs, and/or b) sell equity stakes in individual assets they own.

a) Financing individual catalogues: Some creators have taken on external capital to finance their content business. For example, Colin & Samir, GamingWithKev and 700+ other YouTubers have worked with Spotter, which offers creators a lump-sum payment in exchange for a license to earn a portion of their AdSense revenues. Content financing solutions like these grew common in 2020-2021. At the start of Covid, many creators found themselves in a cash crunch when brands momentarily paused ad spend. Then, as Covid became a tailwind for them, creators saw an opportunity to invest working capital in their content. Simultaneously, low interest rates helped companies like Spotter make these investments with relatively cheap debt. (Interestingly, music catalog investors used a similar arbitrage strategy).

b) Selling equity stakes in other assets: Other creators raised capital by selling equity stakes in individual brands they launched. Emma Chamberlain’s Chamberlain Coffee, Nelk Boys’ Happy Dad seltzer, and Logan Paul & KSI’s Prime Hydration headline a long list of creator-led brands that have raised capital from institutional investors recently.

The underlying rationale is similar to Hollywood celebrity-run businesses, like Rihanna’s Fenty Beauty, George Clooney’s Casamigos and Kim Kardashian’s Skims. Creators have massive marketing channels and deeply loyal communities, which translate to lower CACs and higher LTVs. Furthermore, social media distribution and commerce tools like Shopify have made spinning up a new brand easier than ever. So in the last five years, we’ve seen a rush of creators partnering with consumer VCs and incubators to launch new brands.

But as most major creators sold stakes in content or standalone brands, a few creators have taken a different strategy: allowing investors to invest across their entire flywheel. In other words, they took investment at the holding company level. Examples include:

Last year, Dude Perfect announced a $100 million round led by Highmount Capital. The capital would fund not just content, but also live experiences, merchandise, and a new Texas HQ.

Also last year, First We Feast sold to a group of investors for $83 million. The company includes not just the media brand around Hot Ones, but also a food licensing business.

Last week, Good Good Golf announced a $45 million round led by Creator Sports Capital. While Good Good has nearly 2 million YouTube subscribers, ~75% of its revenue comes from apparel and licensed golf products.

Another interesting case study is Moonbug Entertainment. In 2018, Moonbug was founded and began acquiring YouTube channels in the kids/animated category. Investors funded Moonbug over various rounds through 2021, when Moonbug and its portfolio of IP were sold to Candle Media for $3 billion. Moonbug’s revenue wasn’t just ads from content, but also consumer products, licensing and music distribution.

One fund, Slow Ventures, has taken a portfolio approach to creator HoldCos. According to their website, they raised a $60 million fund to write $1-3 million checks and acquire ~10% stakes in multiple creator HoldCos. Their strategy appears to mainly target niche creators. For example, Slow invested in the holding company behind the VINWiki YouTube channel for car enthusiasts, as well as the website Vinwiki.com, a crowdsourced platform meant to be the go-to source for documenting a car’s history.

Not every HoldCo looks exactly alike. But most have the same high-level structure. Creators house their assets under one parent entity (can be an LLC or C-Corp). This parent company can raise capital, retain governance and centralize key strategic decisions. Underneath this entity, the creator can contribute tto their businesses, each of which may hire their own teams, raise capital and make key operating decisions. Beast Industries is roughly structured as such.

Part 2: Why does the HoldCo model make sense for investors and creators?

We believe more creators will structure their businesses as a holding company, like Beast Industries.

Granted, an individual creator-led brand that raises capital at the asset level can be an incredible outcome. For example, the first checks into Prime Hydration – which drove $1.2 billion in 2023 sales (though sales declined in 2024) – must be happy with their investment.

But we believe the HoldCo model has several advantages for both creators and investors.

The HoldCo model…

1. Enables a flywheel effect across verticals

Every vertical of a creator’s business should reinforce the others. For example, MrBeast’s YouTube videos plug Feastables, whose boxes include ads for Beast Games on Amazon, which drives more interest for MrBeast’s YouTube videos. This flywheel / 360 monetization concept isn’t new, and it goes back to Walt Disney’s famous flywheel from 1957. But it’s hard to nail. If each of MrBeast’s brands operated independently – and with fiduciary duties to different investors – it’d be difficult to achieve alignment across business units. But because Beast Industries has one CEO in Jeffrey Housenbold and one bottom line, all of MrBeast’s business lines can optimize synergies. Beast Industries can plan its content calendar around new product launches; coordinate cross-marketing campaigns across different products; and space out PR announcements to stay in the zeitgeist.

2. Aligns incentives between creators and investors

Every major creator has to juggle multiple priorities. For example, Charli & Dixie D’Amelio have their YouTube, Tik Tok, Instagram and Hulu content; a skin care brand ZitsAllRight; a fashion brand DAM FAM Merch; and a footwear brand D’Amelio Footwear. If I were an investor in any one brand, I’d want the D’Amelios to spend disproportionate time promoting that brand. If I were an investor in just their content, I might not want them to spend any time at all promoting their brands. The HoldCo model aligns incentives by offering investors exposure across all of a creator’s assets. As a result, no matter how creators allocate their resources across business lines, investors can trust they are acting in the interests of the same bottom line. This incentive alignment will help creators attract investors and access more capital.

3. Offers strategic support and advisory

It’s critical to emphasize: Investors should let creators run their business! Investors shouldn’t add layers of bureaucracy and unnecessary financial reporting requirements, or act like they know what fans want better than the creator does. With that in mind, the right investors can offer creators strategic support and advisory in certain categories. First, investors might encourage creators to think bigger-picture and longer-term via the fundraising process and board meetings. Second, investors might push creators to operationalize and formalize parts of their business, which could attract better executive talent. Third, investors who spend all day evaluating new businesses could help evaluate the launch of new business units. Again, it can’t be emphasized enough: An investor should stay in their lane. But with the right working relationship, an investor can provide a creator with expertise in key areas.

4. Increases creators’ financial security and risk tolerance

Some of the world’s largest creators have surprisingly illiquid net worths. This is because they spent years reinvesting any earnings in upleveling their content, hiring a team, etc. Raising capital can allow creators to take some chips off the table while still remaining incentivized to grow. The goal is not for the creator to stop working; any savvy investor will be sure to include “key man” provisions in their contracts. But once a creator gets financial security, they could have a newfound risk tolerance to swing for the fences with more ambitious businesses. This appeals to investors seeking venture-scale returns, as well as creators looking to build the largest business possible while derisking their net worth.

5. Works towards a mutually-beneficial exit scenario

Creator burnout is a real threat. A creator could run their business for 10+ years, burn out over time, lose some of their audience, and find their business in a devalued state. Taking on investment addresses this threat by forcing both creators and investors to work towards a common goal: an exit. VC and PE firms typically have holding periods of 7-10 and 3-7 years, respectively. When that period ends, an ambitious creator doesn’t need to step back; they can take on capital from other investors. But just having this timebound period and exit scenarios in sight will help protect a creator’s asset value long-term. Furthermore, with a HoldCo structure, content drives top-of-funnel awareness for business extensions that are potentially more valuable than a pure-play media asset. Having a diversified portfolio beyond just content can help with a creator’s burnout and potential for a more lucrative exit. If a creator is solely focused on content, they will have to perpetually focus on that. Building a catalog of products will allow creators to create brands that can grow beyond themselves.

Part 3: What criteria would we use to evaluate an investment into a creator HoldCo?

Here are the three most important criteria we’d analyze.

1. How does the creator convert viewers into customers?

It’s table stakes to compare a creator’s audience size and engagement, as well as their topline revenues and overhead costs. But beneath those figures, it’s critical to understand how they’ve converted fans from viewers on social media into buyers on other platforms. For their owned brands, we’d want to assess the CAC and LTV figures, as well as their ability to drive repeat business across different products. For their non-owned brands (i.e. sponsorship deals), we’d want to assess the conversion data and ROI of those deals. This will show whether a creator can both engage fans with content and also convert those fans into paying customers. It’s also important to understand a creator’s target demo. Creators with higher-value audiences (i.e. tech content vs kids content) will drive higher CPMs and larger sponsorship deals, and could also find more lucrative adjacent business opportunities.

2. Why does the creator have a right to win?

It’s essential to believe that a creator has a right to win authentically in their category. Creators have gotten flamed by fans for selling inauthentic products that feel like cash grabs. There have been many examples of this, including Haliey Welch’s (Hawk Tuah Girl’s) memecoin. Creators must have an authentic reason to launch their product, and a right to win in the larger competitive landscape. It’s worth noting that many product categories have grown increasingly crowded with creator brands: sports drinks, beauty, fashion, and food & beverage. Longevity supplements and programs have been the latest trend. That makes it increasingly difficult for any one creator to win. We see opportunity for creators to launch businesses in new categories that aren’t typically associated with creators. Just one interesting area is emerging sports leagues. Jake Paul launched Most Valuable Promotions, the boxing promotion company that’s hosted his fights including the Paul-Tyson fight. IShowSpeed and KSI are key partners in Baller League, a new six-on-six soccer league launching this month. In this other essay, we discussed how new leagues can be venture-scale outcomes.

3. Is the creator a visionary leader?

Lastly, like any venture-backed CEO, the creator must be a visionary leader with ambitions to build a massive business. As mentioned earlier, MrBeast has a level of intensity, sophistication and ambition that would rival any tech entrepreneur. That said, not every investable creator needs to fit MrBeast’s mold. After reaching $5-10 million in revenue, creators often hire a full-time CEO to manage business operations while they focus on creative. But the creator still sets the tone and serves as the figurehead for every business in their flywheel, so it’s critical for them to be charismatic leaders with big ambitions. The creator must also be able to delegate work. For example, many creators struggle to scale their content operations because they have very nuanced ideas of how to edit their videos and don’t invest time in training a larger editing team. Surprisingly, some of the world’s most-followed YouTube channels are a two or three-person editing desk. It’s critical for a creator to operationalize the creative process around them and build trust with executives to help grow their business.

##

It’s important to note: We don’t see a one size fits all definition of an investable creator.

YouTubers like MrBeast are just one category. Investable creators could be a traditional media personality like Stephen A. Smith, a Twitch streamer like Kai Cenat, or even a group of podcasters like The Fantasy Footballers. We view an investable creator as anyone with a large, passionate audience – and the desire to build large businesses off the back of it.

MrBeast might be the first $5 billion digitally-native creator. But as more billion-dollar creators emerge, we believe more will choose to structure their businesses and take on capital as holding companies.

At Will Ventures, we’re excited to explore investments in this category. If you’re a creator, operator or investor in the space, please reach out. We’d love to hear your thoughts.

This is such a great piece - thank you for going deep on it. I’m particularly interested in these types of business and I wrote about this topic in December. When the content at the top of a HoldCo funnel becomes profitable itself, companies can actually achieve the magical concept of “Negative CAC”…

https://www.dashmedia.co/p/eieiocac-hack